In some subject areas, it makes sense to accept that we’re on the outs. For example, computer programming languages are definitely over my head. I’m okay with that. Computer programming is a specialization. Yes, it touches my life. But I’m okay with leaving it to the experts.

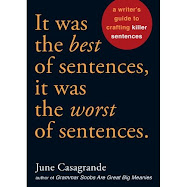

Our language is different. English is not used only by some very specific workers operating in a very specific segment of the economy. We all use it every day. It belongs to us all. So I find it troubling when people resign themselves to a position of “Oh, I’m so ignorant about grammar. I wish I knew it, but I don’t.”

It’s a form of giving up. Of divesting.

It’s unfortunate and unnecessary, and it leads to some opportunistic B.S. I often term grammar snobbery. So I have tried, in my own little way, to storm (from the inside) the gates of this knowledge ghetto.

This is on my mind today because I’ve been thinking about a knowledge ghetto in a very different realm: economics.

Most people I know feel that the intricate workings of the economy are “over their heads.” It’s difficult, abstract, complicated stuff best left to the experts – or so the general feeling seems to be. We assume that the experts are doing a far better job than we could ever do. In fact, we feel that the subject is so far over our heads that we’re not even qualified to question those experts. There’s no use even trying to learn enough to scrutinize their decisions. We’re at their mercy – and that’s not a bad place to be.

I used to think that this was a reasonable attitude toward economics. I don’t study computer programming languages so that I can cast better votes at the shareholder meetings of Microsoft or Apple. Similarly, it seems silly to assume that by learning more about economics I can become a significantly better citizen. The experts are experts. I’m an “other.”

Or so I thought.

Then two things happened.

The first was in October, when former Federal Reserve Chairman Alan Greenspan was called onto the carpet in front of our nation’s lawmakers to answer for the financial crisis. The man long considered an “oracle” of the nation’s economy, according to the Los Angeles Times, told representatives that the current crisis exposed a “flaw” in his ideology.

"I made a mistake in presuming that the self-interests of organizations, specifically banks and others, were such as that they were best capable of protecting their own shareholders and their equity in the firms," Greenspan said.

Yup, the man who chaired the Fed for nearly two decades had been operating the whole time on a false assumption. He assumed that banks and other financial firms were too smart to shoot themselves in the foot. He believed, without question, that self-interest was the only insurance we needed to prevent this collapse.

D’oh.

The second thing that happened was that I began watching video installments of a college economics class. In the lecture series, Pepperdine professor Dean Baim uses the inflation crisis of the 1970s to discuss the concept of interest.

According to Baim, sometime by the mid-1960s, experts in the Federal Reserve had observed that interest rates went up whenever the demand for money went up. That is, whenever more people wanted to borrow money, lenders would increase interest rates. It’s the simple law of supply and demand at work: When demand goes up and supply does not, prices go up. It’s why Picasso paintings are worth more than posters of Picasso paintings.

So, because the interest rate tended to correlate with demand for money, the Fed decision makers decided to use it as an indicator of the demand for money. See the problem already brewing? Just because one thing causes interest rates to go up doesn’t mean there aren’t other things that can make it go up, too.

As it turned out, from the mid-1960s through the ’70s, there actually were other factors causing interest rates to go up. Increased government spending at a time of nearly full employment was causing inflation. (Basically, government was adding demand for products and services at a time when the country was already producing those goods and services at nearly full capacity. So, increased demand without a corresponding increase in supply created inflation.) That inflation, in turn, was causing interest rates to go up. (This, too, is a very simple dynamic. As Baim illustrated, if inflation is 3 percent this year and you think it’s going up even further, you’re not going to lend me money for 2 percent. You’d end up with less spending power instead of more.)

But the Fed stuck to its simplistic view that interest rates are an indicator of the demand for money. So they printed more money. With more money in their hands, people wanted to buy more stuff. But the economy couldn’t really make any more stuff. So the prices went up. That is, inflation increased. That, in turn, led to more hikes in interest rates. That, in turn, led to the Fed geniuses saying, “Guess we should print more money.” That, in turn, led to more inflation, which led to more interest rate hikes, which led to Fed experts pouring more gasoline on the fire.

In other words, the “experts” were stupid.

Decades later, the “experts’” stupidity strikes again: Greenspan and company clung to the belief that bankers wouldn’t shoot themselves in the foot by buying crazy-bad debt. Then the bankers did just that.

The inflation-related catastrophe of the 1970s and the current economic catastrophe both happened in part because experts clung to alarmingly stupid oversimplifications.

None of the economic concepts here are over my head. None of this is too difficult to understand. Indeed, just by investing a little time in learning about this stuff, I can --quite intelligently -- scrutinize the prevailing expertise.

I’ll be the first to admit that ignorance can be pleasant – downright cozy, in fact. I love not having to worry about every aspect of how my computer works. I love not having to worry about how my car works. I love not having to figure out how to get cheap electric toothbrushes out of China and into my local Target store. I love not having to worry about how to get electricity to my home to make a lamp work. I love not having to worry about making sure there’s enough cabin pressure in a plane I’m flying on. In all these cases, I know that there are people – an almost paternalistic presence – taking care of these things for me. I love that.

In all these knowledge sets, I’m in the ghetto. And I’m okay with that. But not with economics. Not anymore. For me, that subject is no longer clumped in with C++ and aeronautics.

It’s more like grammar: a subject on which I will no longer respect the fence between the so-called experts and me.

2 comments:

As an economist by training, though not by occupation, I certainly appreciate your advocacy of greater economic literacy - too many people view it as a dry subject with no bearing on their lives. While this may be true of upper-level economic theory, that is probably true of every discipline imaginable. Most people can easily understand the basics of economics, just as most people can understand the basics of aeronautics (wind resistance increases with increases in speed) and most people could get a rudimentary understanding of programming by looking at some code with understanding of what it does.

We economists also need to do a better job of making our chosen discipline less opaque to those who do not share our interest in it, something we sometimes find difficult to do for various reasons.

PS - Economist/economics jokes are among the worst available.

Well put. And now that I think about it, I suppose Paul Krugman helped get me this far by making the subject seem more amenable.

Anyway, there's probably never been a time better suited to promoting economics literacy. The terminology on NPR, in the LA Times and on NBC Nightly News these days are a lesson in themselves!

Post a Comment